Concept of Money Market

The money market is a segment of the financial market where short-term borrowing, lending, buying, and selling of financial instruments take place. These transactions typically involve instruments with high liquidity and short maturities, generally one year or less. The primary purpose of the money market is to provide a mechanism for managing short-term funding and liquidity needs for governments, financial institutions, and corporations.

Features of Money Market

- Low Transaction Cost: Financial operations in the money market are conducted with minimal fees or expenses, making it cost-effective for participants.

- Short-Term Instruments: The market deals with financial tools that have quick turnover and maturity periods, usually within a year or less. Examples include Treasury bills, commercial paper, and certificates of deposit.

- High Marketability: Assets in the money market can be easily bought or sold, which provides high liquidity to the participants.

- Low Default Risk: Investments in the money market are generally considered low risk, with minimal chances of failure or loss due to the high creditworthiness of the issuers and short-term nature of the instruments.

1. Raising the Funds

Raising the funds refers to the process of generating capital or financial resources. In the money market, this is done through the issuance of short-term instruments like Treasury bills, commercial paper, and certificates of deposit. This function is crucial for businesses and governments to obtain the necessary funds to finance their operations and projects.

Example: A government might issue Treasury bills to raise funds for infrastructure projects, while a corporation could issue commercial paper to cover short-term expenses such as payroll or inventory purchases.

2. Supplying the Funds

Supplying the funds involves providing financial resources to entities that need them. Financial institutions, such as banks, play a significant role in this function by offering loans or purchasing short-term securities. This ensures that there is a steady flow of funds available for various economic activities.

Example: A bank might provide short-term loans to businesses to help them manage cash flow during peak seasons or invest in short-term securities like Treasury bills to earn returns on excess cash.

3. Meeting Daily Expenditure

Meeting daily expenditure highlights the role of the money market in providing liquidity to meet day-to-day operational expenses. This function ensures that businesses and individuals have access to cash for their immediate needs, facilitating smooth and continuous operations.

Example: A company might use money market funds to cover daily operational costs, such as paying suppliers or utility bills, ensuring that their operations run without disruption.

4. Raising and Investing Temporary Funds

Raising and investing temporary funds involves the short-term borrowing and lending of funds. This function allows entities to manage their temporary cash surpluses or deficits effectively. Financial instruments such as repurchase agreements (repos) and federal funds are commonly used for this purpose.

Example: A business experiencing a temporary cash surplus may invest in short-term instruments like commercial paper, while a financial institution needing quick cash may engage in repurchase agreements to meet its liquidity requirements.

5. Synchronizing Cash Inflows and Cash Outflows

Synchronizing cash inflows and cash outflows ensures that the timing of cash receipts and payments is aligned. This helps in maintaining a balance between incoming and outgoing cash flows, thereby avoiding liquidity issues. The money market provides instruments and mechanisms to manage this synchronization effectively.

Example: A company might use short-term loans or invest in money market instruments to ensure that cash inflows from sales align with outflows needed to pay suppliers, preventing any cash flow mismatches.

Money Market Instruments

Discount Securities

Treasury Bills (T-Bills)

These are short-term government securities with maturities ranging from a few days to one year. They are issued at a discount to their face value and do not pay periodic interest. The return to the investor is the difference between the purchase price and the face value at maturity.

Commercial Paper

This is an unsecured, short-term debt instrument issued by corporations to meet their immediate financial needs. It typically has a maturity period of 1 to 270 days. Being a discount instrument, it is sold at a discount and redeemed at face value.

Banker's Acceptance

A time draft guaranteed by a bank, often used in international trade. It represents a future payment backed by the bank's creditworthiness. These are sold at a discount and pay the full face value at maturity.

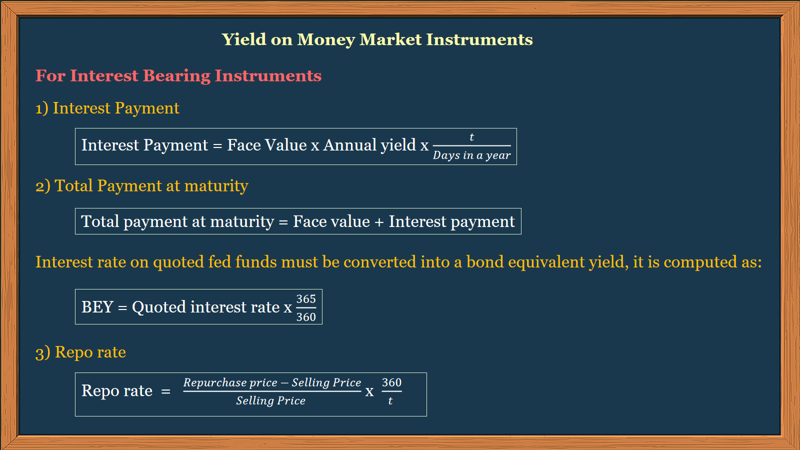

Interest-Bearing Securities

Certificates of Deposit (CDs) These are time deposits offered by banks that pay interest at a specified rate. CDs have fixed terms, which can range from a few weeks to several years. Upon maturity, the original investment plus interest is returned to the investor.

Eurodollar Deposits

U.S. dollar-denominated deposits held in foreign banks or in the foreign branches of American banks. They pay interest and are used as a means of holding large amounts of U.S. dollars outside of the United States.Federal Funds

These are overnight loans between banks to meet their reserve requirements. The interest rate at which these loans are made is known as the federal funds rate. These loans typically do not involve any collateral.Repurchase Agreements (Repo)

These are short-term borrowing agreements where one party sells securities to another with a promise to repurchase them at a higher price at a later date. The difference between the sale price and repurchase price represents the interest. The reverse of this transaction is called a reverse repo.

practice question ko answer ka xa ?

ReplyDeletePost a Comment

Do Leave Your Comments